IMA CMA Strategic Financial Management Übungsprüfungen

Zuletzt aktualisiert am 26.04.2025- Prüfungscode: CMA Strategic Financial Management

- Prüfungsname: CMA Part 2: Strategic Financial Management Exam

- Zertifizierungsanbieter: IMA

- Zuletzt aktualisiert am: 26.04.2025

CORRECT TEXT

Identify and explain two ways for AMI to hedge its exchange rate risk.

Essay

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units.

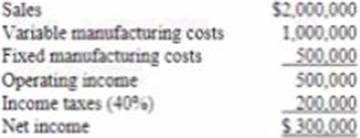

The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.

The human resources manager of BankUS has noted mat me company s employee turnover has increased. He has also had his budget cut, and will have to reduce training for new associates. He has a meeting scheduled with the CFO lo go over risks that his department faces.

What should the human resources manager tell the CFO about risk?

- A . He should notify the CFO of a potential operations risk

- B . Me does not need to notify me CFO of a potential risk

- C . He should notify the CFO of a potential internal factor risk

- D . He should notify the CFO of a need for additional funding

The internal audit division of a company is investigating a potential fraud in the Accounts Payable department Someone in the department has been writing checks to fictitious vendors and collecting the cash The primary suspect Is an employee who has own with the company for twelve years and recently lost his Did for promotion to Director of Accounts Payable a position which would have given mm a 25% salary increase This employee has been heard complaining to several other employees in the department that he was cheated out of his raise.

Which one of the following elements of the fraud triangle is this employee exhibiting?

- A . Pressure

- B . Rationalization

- C . Motive

- D . Opportunity

With respect to the COSO Enterprise Risk Management Integrated Framework (2017), which one of the following statements is true regarding Governance & Culture and Performance?

- A . They are both components of the Integrated Framework

- B . Governance & Culture is a principle and Performance is a component of the Integrated Framework

- C . They are both principles of the Integrated Framework

- D . Performance is a principle and Governance & Culture is a component of the Integrated Framework

An organization s sol of values and code or ethics is an important consideration in human resource decisions for each of the following reasons except

- A . employees not motivated to adhere to a set of values may impact relationships wan other entities doing Business e organization.

- B . failure to address the alignment or individual values and ethics with organizational expectations may have a negative impact on performance.

- C . lack of a communicated set of values may create confusion and conflict among employees

- D . an organization may not have a legal right to discharge a dishonest employee if such a code is not communicated

CORRECT TEXT

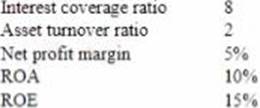

Calculate QDDs financial leverage ratio show your calculations Essay Quality Digital Design (QDD) Inc is a public-traded technology company Selected financial data of QDD for the prior year are as follows

QDD’s stock was trading at $160 per share at the beginning of the yea: and at $176 per share by the end of the year. The company paid dividends of S5 per share. The company "s stock had a beta of 1 4 The stock market provided a total return of 12% last year, well above the 3°o risk free rate of return

QDD is considering the issuance of $200 million of bonds to fund the repurchase of $200 million of its stock. QDD is evaluating the bond, including its term structure, maturity, and whether it should be callable obtaining the lowest coupon interest is an important objective of QDD. The CFO has estimated that sales for the current year would remain the same as last year and the new bond would add S12 million in annual interest payments

In March 20X2, an investor purchased a government bond with a face value of $100 that matures in 30 years. The issue price was $94 and the bond offered a yield to maturity of 5.6% One year later, the investor sold the bond at a price of S105 after receiving an interest payment of $6.

The total return is

- A . 5.6%

- B . 6.0%

- C . 11.7%

- D . 18.1%

Employee performance review and development systems must be fully aligned with the requirements for ethical conduct Ethical expectations should be included in

- A . competencies, only

- B . job descriptions only

- C . competencies and job descriptions only

- D . compliances, job descriptions and objectives

FumiSelf is a global manufacturer of consumer-assembled furniture with a business presence in nearly every country. The Vice President of Production was presented with the following information by the Vice President of Finance as of the end of the current quarter.

- A . Asian division has the highest days‘ sales in inventory

- B . North American division has the lowest days‘ sales in Inventory.

- C . African division is the most efficient in manage its inventory

- D . Europe division is the most inefficient in managing its inventory

CORRECT TEXT

Identify and explain two risks that Guda may face after it acquires Blue Moon.

Essay

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units.

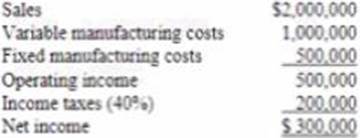

The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.