CIPS L6M5 Übungsprüfungen

Zuletzt aktualisiert am 24.04.2025- Prüfungscode: L6M5

- Prüfungsname: Strategic Programme Leadership

- Zertifizierungsanbieter: CIPS

- Zuletzt aktualisiert am: 24.04.2025

What is the purpose of Cybernetic Control within Project Management?

Answer Options:

- A . To assign resources

- B . To reduce errors

- C . To increase value

- D . To monitor progress

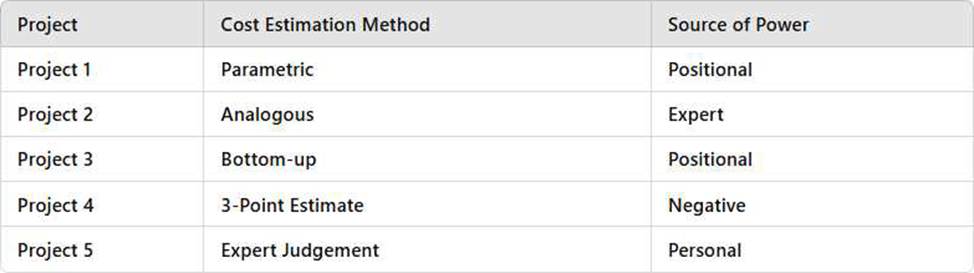

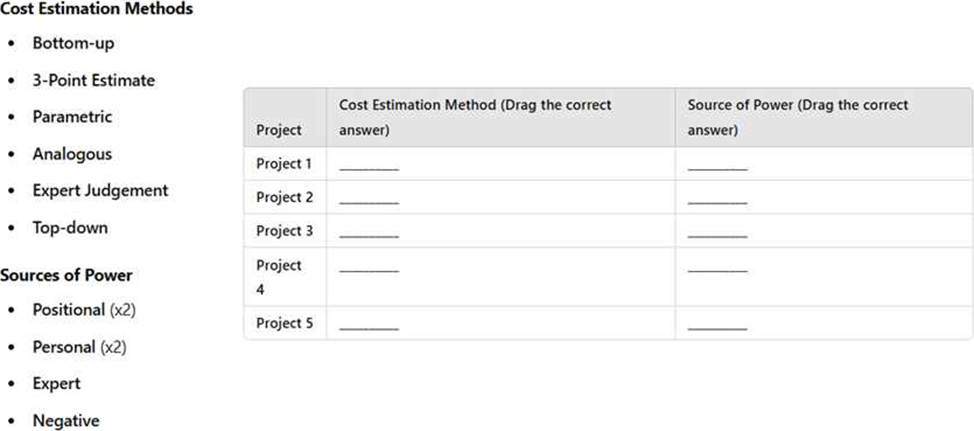

DRAG DROP

KCJ Ltd is a public sector organisation planning five projects for the next financial year. Each project has a distinct cost estimation method and source of power for the project leader.

Your task is to match the correct cost estimation method and source of power to each project.

Project Descriptions

Project 1

Description: Budget estimation is calculated using an algorithm.

Project Lead’s Power: Founder of the organisation.

Project 2

Description: The Head of R&D (PhD in Data Science) is using costing from similar past projects to determine the budget.

Project Lead’s Power: Expertise in Data Science.

Project 3

Description: The project is led by a key stakeholder and involves creating a Bill of Materials. Costs are worked out item by item.

Project Lead’s Power: Authority due to stakeholder influence.

Project 4

Description: The Project Leader has calculated the base cost, most likely cost, and worst-case scenario.

Project Lead’s Power: Has the authority to cancel the project at any time.

Project 5

Description: The project leader is a well-liked Board Member who has selected a team he is comfortable with. He determined the budget based on his own research. Project Lead’s Power: Personal relationships with team members.

Jerry is responsible for starting a new construction project.

His company wants to build a new Water Park on the outskirts of town.

He has prepared a Statement of Need, outlining requirements and benefits.

Senior Management has approved the project to move forward.

Q: What should be Jerry’s next task? Answer Options:

- A . Concept design C outlining how the water park would look and operate

- B . Feasibility study C looking in-depth at options available

- C . Project brief C creating a list of technical requirements

- D . Appointment of a construction manager to manage the project

Liability limitation often focuses on which of the following types of loss, which is said to be the most unpredictable and most significant in the case of a default on a contract?

- A . repudiatory

- B . anticipatory

- C . direct

- D . consequential

Which of the following pieces of information is required to create a Bill of Quantities? Select all that apply

- A . volume of materials used

- B . quality of materials

- C . dimensions of materials

- D . price of material

- E . manufacturer of material

Dave, Head of HR, is introducing the "Person-Organization Fit" model.

Q: What will this help achieve? Answer Options:

- A . Ensuring staff meet their KPIs

- B . More successful recruitment

- C . Less discrimination in the workplace

- D . Better relationships with suppliers

Danger Incorporated is estimating the costs for a new project called the Ninja Project using an algorithm based on the project’s scope, duration, and complexity.

What type of cost estimate is being used?

- A . expert judgement

- B . bottom-up

- C . analogous

- D . parametric

Scenario (same as Question 16):

Fin Inc is working with the new client.

What type of costing system is being used?

- A . open book

- B . fixed fee

- C . bottom up

- D . bill of quantities

What is Earned Value Analysis (EVA) in project management?

Answer Options:

- A . A comparison of where the project is up to vs. where it is forecasted to be

- B . The profit or loss generated by the project thus far

- C . The value of a project, expressed as a percentage of money invested

- D . The amount of resources allocated to a project vs. resources available

Green Thumb Ltd, a landscaping company, is considering investing in a new lawn mower costing £10,000. The CFO estimates that the new machinery would increase annual income by approximately £2,000.

What is the payback period of the investment?

- A . 20%

- B . 10 years

- C . 5 years

- D . £8,000