IMA CMA Strategic Financial Management Übungsprüfungen

Zuletzt aktualisiert am 26.04.2025- Prüfungscode: CMA Strategic Financial Management

- Prüfungsname: CMA Part 2: Strategic Financial Management Exam

- Zertifizierungsanbieter: IMA

- Zuletzt aktualisiert am: 26.04.2025

CORRECT TEXT

Identify and describe two defenses Blue Moon could use if it does not wish to be acquired by Guda.

Essay

Food Depot Ltd, (FDL) is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants, FDL has been profitable in recent years and has a very strong cash position. FDL’s newest division. Food_TO-Go is an online meal ordering and delivery platform acquired by FDL two year ago.

In 20X7, sales for the entire company were $1 billion, with 50% of the business coming from the Airline Catering division. FDL is the country ‘s leading airline catering services provider and control 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-division only contribution 5% of FDL’s total sales in 20X7 and is far behind in competing for marketing for market share of the online meal ordering and delivery industry,

it is estimated that Food-To-Go’s sales were only 20% of the industry leader’s sales.

However, the outlook for the online meal ordering and delivery services industry is bright.

The compound annual growth rate of the industry since it started three years ago was 50%.

It is estimated the rapid growth of the industry will continue in the foreseeable future.

Susan Willey, the head of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company. Wiley argues that ber division bad the highest ROI in 20X7, and it deserves more capital finding. FDL’s requested rate of return is 12%.

The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follow (in $ millions)

![]()

A group of nations is considering me formation of a cartel associated with the manufacture and distribution of a product that they each export.

Which one of the following outcomes would not be consistent with me formation of a carter?

- A . An increase in the output of the manufactured product

- B . An increase in the selling price of the manufactured product

- C . An increase m the net profits for each of the individual cartel members

- D . A selling price where marginal revenue equals marginal cost

Clark inc, expects to incur the following selected costs an a new product being planned for introduction early next.

✑ Design an development costs of $100,000 that will be incurred this year.

✑ Marketing costs of $50,000 to be incurred %50 this year %50 year

✑ Manufacturing costs of $500,000 to be incurred next year.

✑ In addition to external market factors, the pricing decision should be based on cost.

The product cost that should be used is

- A . $500,000

- B . $525, 000

- C . $550,000

- D . $650, 000

It is possible to eliminate risk in a two-stock portfolio of common stocks if

- A . there perfect positive correlation between the stocks

- B . there is perfect negative correlation between the stocks

- C . there is no correlation between the stocks.

- D . the two stocks have equal positive beta coefficients

Company A is concerned with its debt status and interested in analyzing how each one of the following activities might affect its to equity ratio. Assuming each activity is independent, which one of following activities is

- A . Purchase back some of its common stock during the year.

- B . Acquiring a subsidiary and consolidating for year-end financial statements.

- C . Changing its inventory method from LIFO to weighted average.

- D . Creating a separate entity to purchase a needed machine and leasing it from this entity.

A manufacturing company is reviewing the budget for one of its component parts for next year based on the need for 5.000 units.

The company receives a bid from a supplier offering lo provide (lie needed component for a price of $115 per unit The company is deciding whether to make or buy the component.

What decision should the firm make if (1) the fixed facilities costs can be avoided or (2) if the fixed facilities costs cannot be avoided If purchasing from the supplier?

- A . (1) Make; (2) Make

- B . (1) Make; (2) Buy

- C . (1) Buy; (2) Make

- D . (1) Buy; (2) Buy

If a CMA is asked to conduct a financial assessment of a company owned by a close relative, what would be the proper response under the credibility standard of the IMA

Statement of Ethical Professional Practice?

- A . Advise all parties of a potential conflict of interest

- B . Keep information confidential except when authorized By the relative

- C . Communicate the existence of a constraint that might preclude responsible judgment

- D . Provide an assessment that is timely and accurate despite the personal relationship

When evaluating a capital Budgeting proposal, an advantage of using the payback method is that Bits process

- A . assesses the liquidity of the project.

- B . considers the time value of money.

- C . incorporates all of the project’s cash inflows and outflows

- D . objectively determines if the proposal should be accepted or rejected.

Alliantz Company, a USA-based manufacturer needs to set up a hedge to protect against dollar exchange rate devaluation. The protection is necessary (or an open balance of $2 478.450 Payment is to be settled in a rare currency 40 days from today excluding transaction fees which investment instrument would be used to provide the best hedge?

- A . Stock options

- B . Market-traded futures

- C . Forward agreement

- D . Currency warrant

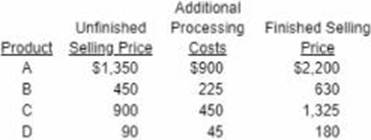

A company has incurred $2,500 to produce its four products. These products can either be sold as is or processed further.

The selling prices and additional costs necessary to finish these products ace shown below

- A . Products A

- B . Products B

- C . Product C

- D . Product D