IMA CMA Strategic Financial Management Übungsprüfungen

Zuletzt aktualisiert am 27.04.2025- Prüfungscode: CMA Strategic Financial Management

- Prüfungsname: CMA Part 2: Strategic Financial Management Exam

- Zertifizierungsanbieter: IMA

- Zuletzt aktualisiert am: 27.04.2025

The best discount rate to the use for evaluate of investment opportunities is the

- A . opportunity cost of capital

- B . risk-free interest rate

- C . average market interest rate

- D . cost of the company’s debt

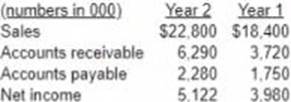

Abex Employment Agency has requested an increase in the firm’s line of credit, and the bank is reviewing Abex’s sales and collections history Although the firm’s sales have increased the bank is concerned about the credit quality of the firm’s customers

Based on the following information calculate the average collection period for the firm Use a 365-day year in your calculations.

- A . 80 days

- B . 88 days

- C . 99 days

- D . 101 days

CORRECT TEXT

Identify and explain the type of acquisition that would occur if Guda acquires Blue Moon.

Essay

Food Depot Ltd, (FDL) is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants, FDL has been profitable in recent years and has a very strong cash position. FDL’s newest division. Food_TO-Go is an online meal ordering and delivery platform acquired by FDL two year ago.

In 20X7, sales for the entire company were $1 billion, with 50% of the business coming from the Airline Catering division. FDL is the country ‘s leading airline catering services provider and control 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-division only contribution 5% of FDL’s total sales in 20X7 and is far behind in competing for marketing for market share of the online meal ordering and delivery industry, it is estimated that Food-To-Go’s sales were only 20% of the industry leader’s sales. However, the outlook for the online meal ordering and delivery services industry is bright.

The compound annual growth rate of the industry since it started three years ago was 50%.

It is estimated the rapid growth of the industry will continue in the foreseeable future.

Susan Willey, the head of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company. Wiley argues that ber division bad the highest ROI in 20X7, and it deserves more capital finding. FDL’s requested rate of return is 12%.

The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follow (in $ millions)

![]()

IF a company does not have a code of conduct, the company most likely

- A . is missing important guidance on ethical decision making

- B . will lack an expressed statement of values regarding ethical behavior

- C . can use its statement of values instead to implement ethics in daily decision making

- D . must find another way to express its ethical principles

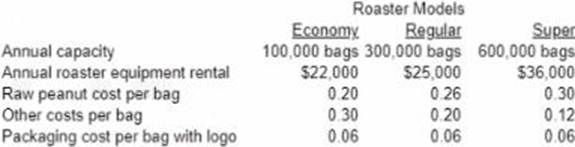

L&H Sports owns and operates several stadiums used for baseball and soccer games Management is considering installing machines that would be used to roast peanuts on the premises. This equipment would allow L&H to sell freshly roasted peanuts rather than the pre-roasted peanuts that are currently sold Marketing studies suggest that this feature would increase peanut sales.

The roasters can be purchased in several sizes, and the annual rental fees and operating costs vary with the size of the roaster Information about the roasters is shown below.

L&H currently sells pre-roasted peanuts for $0 60 pet bag. Management plans to sell the freshly roasted peanuts for a higher price but at no more than a 10% increase. The demand for freshly roasted peanuts is estimated to be 250, 000 bags pet year.

Which roaster should L&H purchase to maximize its profit?

- A . Economy

- B . Regular

- C . Super

All of the following describe ethical leaders except

- A . dedicated leaders who can keep promises and commitment

- B . flexible leaders how new ethical behavior to be negotiable

- C . supportive leaders who encourage employees to adhere to company policy

- D . leaders who demonstrate high ethical standards

CORRECT TEXT

Explain the impact of a sales price adjustment on AMI’s operating income if AMI’ s operating leverage is higher than that of other companies in its market.

Essay

Food Depot Ltd, (FDL) is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants, FDL has been profitable in recent years and has a very strong cash position. FDL’s newest division. Food_TO-Go is an online meal ordering and delivery platform acquired by FDL two year ago.

In 20X7, sales for the entire company were $1 billion, with 50% of the business coming from the Airline Catering division. FDL is the country ‘s leading airline catering services provider and control 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-division only contribution 5% of FDL’s total sales in 20X7 and is far behind in competing for marketing for market share of the online meal ordering and delivery industry, it is estimated that Food-To-Go’s sales were only 20% of the industry leader’s sales. However, the outlook for the online meal ordering and delivery services industry is bright.

The compound annual growth rate of the industry since it started three years ago was 50%.

It is estimated the rapid growth of the industry will continue in the foreseeable future.

Susan Willey, the head of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company. Wiley argues that ber division bad the highest ROI in 20X7, and it deserves more capital finding. FDL’s requested rate of return is 12%.

The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follow (in $ millions)

![]()

Selected data for Bittner, inc is shown below (in thousands)

- A . 52.73%

- B . 52.25%

- C . 47.75%

- D . 4727%

Using the dividend discount model, an analyst determines mat Beverly Company’s equity is worth $80 per share.

Beverly Company’s required rate of return is 15% and the current risk-free rate is 5% assuming a 0% long-term growth rate, what is Beverly’s estimated future annual dividend?

- A . $16.00

- B . $12.00

- C . $8.00

- D . $1.20

CORRECT TEXT

Define the term structure of interest rates and explain now it could impact QDD’s objective of obtaining the lowest coupon rate

Essay

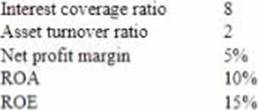

Quality Digital Design (QDD) Inc is a public-traded technology company Selected financial data of QDD for the prior year are as follows

QDD’s stock was trading at $160 per share at the beginning of the yea: and at $176 per share by the end of the year. The company paid dividends of S5 per share. The company "s stock had a beta of 1 4 The stock market provided a total return of 12% last year, well above the 3°o risk free rate of return QDD is considering the issuance of $200 million of bonds to fund the repurchase of $200 million of its stock. QDD is evaluating the bond, including its term structure, maturity, and whether it should be callable obtaining the lowest coupon interest is an important objective of QDD. The CFO has estimated that sales for the current year would remain the same as last year and the new bond would add S12 million in annual interest payments